Alibaba

myinvestingnotes.blogspot.my (Bullbear Buffett Stock Investing Notes)

Keep INVESTING Simple and Safe (KISS) ****Investment Philosophy, Strategy and various Valuation Methods**** The same forces that bring risk into investing in the stock market also make possible the large gains many investors enjoy. It’s true that the fluctuations in the market make for losses as well as gains but if you have a proven strategy and stick with it over the long term you will be a winner!****Warren Buffett: Rule No. 1 - Never lose money. Rule No. 2 - Never forget Rule No. 1.

Friday 19 April 2024

Monday 15 April 2024

With a few simple steps, you could be on your way to millionaire status.

This Is Hands-Down the Simplest Way to Earn $1 Million or More in the Stock Market

By Katie Brockman – Apr 13, 2024 at 4:00PM

KEY POINTS

Building wealth in the stock market requires a long-term strategy.

Consistency is key to reducing risk while maximizing earnings.

The investments you choose can make or break your portfolio.

With a few simple steps, you could be on your way to millionaire status.

Investing in the stock market is a tried-and-true way to generate long-term wealth, and while reaching $1 million may seem like a lofty goal, it's not as difficult as it might appear.

You don't have to be a stock market expert to earn $1 million or more, but you will need the right investing strategy. There's no single correct way to invest, and the best approach for you will depend on your preferences and risk tolerance.

That said, there's a simple and straightforward strategy to maximize your long-term earnings while minimizing risk. Whether you're new to the stock market or just want a no-fuss way to build wealth, this step-by-step process can take you from $0 to $1 million or more.

1. Get started investing right now

The more time you give your money to grow, the less you'll need to invest each month to reach $1 million. Thanks to compound growth, your investments will accumulate exponentially faster over time. Getting started as soon as possible, then, is key to maximizing your earnings.

Even if you can't afford to invest much right now, every year counts. For example, say you're earning a modest 9% average annual return on your investments -- which is just under the market's historic average. Here's approximately how much you'd need to invest each month to reach $1 million, depending on how many years you have to save:

NUMBER OF YEARS AMOUNT INVESTED PER MONTH TOTAL PORTFOLIO VALUE

20 $1,700 $1.044 million

25 $1,000 $1.016 million

30 $625 $1.022 million

35 $400 $1.035 million

40 $250 $1.014 million

DATA SOURCE: AUTHOR'S CALCULATIONS VIA INVESTOR.GOV.

It's never too early to start investing, and the sooner you begin, the easier it will be to build a substantial amount of wealth. You can always invest more later if you can swing it, but you won't get this precious time back.

2. Don't worry about timing the market

The stock market will always be volatile to a degree, and it can be nerve-wracking trying to determine the best time to buy. Many people are understandably worried about investing right before prices drop, and it can be tempting to hold off on buying until the perfect moment.

However, there's never going to be a perfect time to invest in the stock market, and the longer you wait to invest, the harder it will be to catch up later. While it may seem counterintuitive, it's often safer to simply invest consistently no matter what the market is doing.

This approach is called dollar-cost averaging, and it involves investing a set amount at regular intervals throughout the year. Sometimes you'll end up buying when prices are at their peaks, and other times you'll snag investments at steep discounts. Over time, those highs and lows should average out.

Dollar-cost averaging can help take the guesswork out of when to buy, making it easier to invest consistently. Again, time is your most valuable resource when building wealth, so consistency is key to reaching $1 million or more.

3. Choose long-term investments

All investments are subject to short-term volatility, but stocks from healthy companies with solid underlying fundamentals have the best chance of recovering from downturns and earning positive long-term returns.

These types of stocks won't see explosive growth overnight, but they are more likely to earn consistent returns over time. This makes them much safer than short-term investments promising to make a quick buck.

If you'd prefer a more low-maintenance investment, a broad-market index fund or ETF may be your best bet. The S&P 500 index fund, for example, tracks the S&P 500 index and includes stocks from all 500 companies within the index itself. This can help create an instantly diversified portfolio with next to no effort, limiting your risk while still setting you up for positive long-term returns.

If you're willing to put in more effort for the chance to earn above-average returns, investing in individual stocks may be a better fit. This approach requires more research, as you'll need to study each stock you're interested in buying as well as keep up with industry trends going forward. But with the right portfolio, you could earn far higher-than-average returns over time.

Building a million-dollar portfolio isn't necessarily easy, but it's simpler than it might seem. By getting started early, investing consistently, and keeping a long-term outlook, you'll be on your way to becoming a stock market millionaire.

https://www.fool.com/investing/2024/04/13/simplest-way-earn-1-million-in-stock-market/

Sunday 14 April 2024

Johnson & Johnson

Johnson & Johnson: Doubling Down On This 2024 Dog Of The Dow

Apr. 12, 2024

Summary

Johnson & Johnson (JNJ) is positioned to gain on the upside due to solid financials, consistent dividend streak, and potential increase in healthcare spending.

JNJ is included in the Dogs of the Dow list for 2024 and I plan to capitalize on the opportunity.

JNJ's financials show impressive growth in both the Innovative Medicine and MedTech segments. The FY24 outlook is strong with continued growth on the runway.

Running a dividend discount calculation gets us to a fair estimated stock price of $188.85 per share. This indicates a double digit upside.

The dividend has been increased for over 61 consecutive years. The current dividend yield is 3%, which sits above the 4 year average yield of 2.66%.

Overview

Johnson & Johnson (NYSE:JNJ) has always been one of those companies that has a product and service offering so wide and large that JNJ can be considered its own healthcare ETF. Johnson & Johnson operates within the healthcare space with focus on some of the following segments: immunology, infections, neuroscience, and oncology to name a few. In addition, they also operate a segment called MedTech, that provides interventional solutions. With solid financials, a consistent dividend streak, and perseverance within an industry that's been lackluster for some time now, I believe JNJ is more attractive than ever and the price is positioned to gain on the upside.

Chart

Data by YCharts

The real disconnect has from the Healthcare Sector (XLV) started back in the pandemic drop of 2020. Despite some ongoing headwinds, I believe we are set to see a very profitable future ahead of us with with interest rates eventually being cut and a large increase of healthcare spending throughout the US. I believe there is a current price connect and I am doubling my position after this recent price drop to the $150 per share level. This is because I think that JNJ is undervalued in terms of valuation. For instance, the current P/E ratio (price to earnings) sits at 17.36x, which sits below the 5 year average P/E as well as the sector median.

JNJ has already reported their Q4 earnings in January to close off their fiscal year 2023. They are set to report their upcoming Q1 earnings on the 16th of April so I will also cover some rough estimates of mine alongside what my future out look is for the company. The current dividend yield is slightly over 3% and JNJ is one of the most reliable dividend stocks in history. They have managed to increase the dividend for over 61 consecutive years, making JNJ a member of the elite Dividend Kings club. Lastly, I wanted to share something that's probably already known, but JNJ has made 2024's Dog's Of The Dow list so I look to take advantage of this opportunity as well.

Dog Of The Dow

The Dogs of the Dow strategy is something that is super simple to implement in practice. It focuses on selecting companies within the Dow Jones 30 index that has the highest current dividend yields. A higher yield in this blue chip context can be for a variety of reasons; maybe the fundamentals have weakened, the industry as a whole is suppressed, or the company is performing badly. Either way, making this list usually means that the price has fallen below its usual trading range.

Since price and dividend yield are inverse of one another, the drop in price causes the yield to spike to levels higher than the normal range. By using this strategy, I aim to capitalize on this elevated dividend yield as I believe the fundamentals of the company are strong enough to bring the price back to the highs. For context, here are the current Dogs Of The Dow:

Symbol Company Yield

(VZ) Verizon 6.51%

(MMM) 3M 5.45%

(WBA) Walgreens 5.21%

(DOW) Dow 4.68%

(CVX) Chevron 4.02%

(IBM) IBM 3.51%

(AMGN) Amgen 3.33%

(KO) Coca-Cola 3.25%

(CSCO) Cisco 3.20%

(JNJ) Johnson & Johnson 3.13%

Like I said, companies can make this list because of their recent poor performance in the short term. For example, Walgreen (WBA) has struggled to continue growing sales for an extending period of time. As a result the share price collapse by approximately -50% over the last 1 year period. Even with a recent dividend cut of -48%, the yield is still inflated to over 5.2%. The same story here for 3M (MMM) has caused the price to struggle for an extending period of time; lower growth metrics, slump in meaningful growth prospects, and a decreasing level of free cash flow. As a result MMM's dividend yield is historically high at 5.4%.

However, some companies make the list due to factors outside of their control. For example, Dow (DOW) has struggled to gain any meaningful momentum due to a combination of higher interest rates, poor macro environment for their industry, and lower profit margins outside of their control. However, they have strategically and efficiently managed their cash to navigate these rough times. As a result, they have a great future ahead once pricing and margins become more attractive. I wrote all about it in depth in my previous article titled: 'Dow: Q4 Earnings Reinforce Great Cash Management For This Stock'.

I wanted to highlight this strategy because it has seen impressive results in recent history. We can see how the Dogs outperform the S&P 500 in return for 4 out of the 5 years listed. Similarly, the Dogs outperform the Dow Jones for 3 out of 5 years listed. While its by no means a perfect strategy, it does offer a bit of a defensive stance as the Dogs typically held up better during down years.

Dogs Of The Dow performance comparison

Dogs Of The Dow

Financials

JNJ operates in two main segments: Innovative Medicine sales & Worldwide MedTech sales. Both of these segments have seen impressive growth metrics with the Innovative medicine segment growing sales by 9.5% for 2023, excluding Covid-19 vaccine related sales. Similarly, the MedTech segment experienced a 9.1%% operational sales growth. Growth in these segments can be attributed to increases in surgery, orthopedics, interventional solutions, and vision.

JNJ reported their Q4 earnings in January to close of their fiscal 2023 figures. As a result we can see that growth was achieved worldwide. JNJ closed off 2022 with $80B in sales worldwide and this has now increased to $85.2B. The only region that experienced a decline was the European market but even then, it was slight a slight decrease from $20.7B to $20.4B which is negligible. Reported sales great by 6.5% to close the year.

JNJ full year sales 2023

Q4 JNJ Presentation

Adjusted earnings per share [EPS] for the full year also saw impressive growth of 11.1%, increasing from $8.93 at the close of last year up to $9.92. Between the two segments, Medtech is where the most impressive growth has taken place. The segment has operational growth of 13.4% for Q4 with Interventional Solutions growing by a whopping 52.3% due to new products such as QDOT and OCTARAY having success in the markets they launched within. The other segment, Innovative Medicine, also saw growth of 4% for the quarter. In this segment there was a large decrease in profits from the infectious disease category but this is completely understandable since this mainly consisted of Covid-related revenue.

JNJ capital allocation strategy

Q4 JNJ Presentation

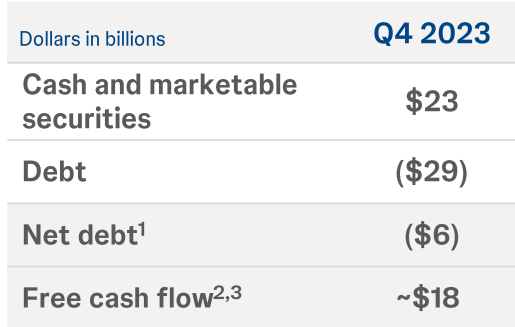

The financial picture here supports the fact that management cares about using capital is the most efficient way possible. They closed out Q4 with a free cash flow of $18B and have successfully used their capital management skills to continue pouring cash back into the business. Cash and marketable securities total $23B while debts total $29B.

Their capital allocation strategy first prioritizes the organic growth needs of different channels within the business. As a result of this, they continue to grow FCF. This FCF can then be used to either invest, growth, research, or develop other areas of their business. Or it can be used to further increase dividend payments and initiate share repurchases.

JNJ closed out their 2023 with over $15B invested into research and development. Over the course of last year they also completed $2.5B worth of share repurchases while paying out a total of $11.8B in dividends to shareholders. This is a company that knows how to handle their cash.

Valuation & Outlook

In terms of valuation, I think that we have a great opportunity for entry at this level. The average Wall St. price target sits at $175.36 per share. This represents a potential upside of 16.75%. I feel highly confident that we are capable of surpassing this price target based on the growth experienced across segments as well as some following valuation metrics. The current P/E ratio sits at 17.36x compared against the sector median P/E of 26.34c. In addition, the 5 year average P/E of JNJ is 20.87x. In addition, the current Price to Book ratio is 4.68 compared to the 5 year P/B ratio of 5.61x.

According to management, adjusted operational sales are estimated to grow at a rate between 5 - 6%. Reported sales are estimated to grow between 4.5% - 5.5% while earnings per share are estimated to grow between 6.4 - 8.4%. Seeing the recent growth delivered over the course of 2023, I think these are highly realistic and likely numbers tat will be achieved. Therefore, I think it would be appropriate to run my own dividend growth model to get another estimated fair stock price.

First, I started by compiling all of the annual dividend payouts for the last few years. Next, I used the estimated annual payout of $4.91 per share for 2024 and inserted it into the calculation. We can see that the dividend has grown at an average of 5.61% per year since 2018. Earnings are expected to grow between 6.4 - 8.4% so I decided to go with a middle of the road input of 7.4% EPS growth. As a result, I determine a fair stock price of $188.85%. This would represent a large potential price upside of approximately 25.7%.

Dividend Discount Calculation

Author Created

Earnings for the full year of 2023 amounted to $10.43/share. Since the growth estimates for each segment are strong, I anticipated a bump in earnings for the full year of 2024. JNJ is set to report their Q1 2024 earnings reported on April 16th. To get a rough estimate, I compiled all of the EPS metrics reported since Q1 of 2019. I took every year's EPS report and calculated out an average EPS growth of 15.74% per year. While this is abnormally strong, I wanted to remain more conservative in my estimate so I want to slice number in half.

Dividend

JNJ has been able to grow their dividend payments for over 61 consecutive years. This puts them in an elite class of dividend kings! As a result they've earned the respect of dividend investors since the income has been so consistent for so any decades. As of the latest declared quarterly dividend of $1.19 per share, the current starting dividend yield is slightly over 3%. For reference, the average dividend yield over the last four years has been 2.66% so you'd be getting a higher yield than normal. The dividend remains well covered with a healthy payout ratio of only 45%. For reference, the average payout ratio of the last 5 years is also 45%. JNJ has about $22.8B in cash from operations to cover any potential headwinds or lack of growth.

Chart

Data by YCharts

We can see how the dividend has grown by 70% over the last decade. Over this time period, this growth equates to a CAGR (compound annual growth rate) of 6.07% over the last ten years. Over a smaller time horizon of 5 years, the dividend has increased at a CAGR of 5.75%. While the yield is only 3%, a larger rate of growth would be more ideal. However, I am thankful that JNJ has not increased the dividend too much since the pandemic because it means they have more cash on hand to ride out the subpar performance of the entire sector and invest in further growth initiatives, acquisitions, and research. For example, JNJ is to acquire Shockwave Medical (SWAV) for $13.1B. Continued moves like this are ways to continue boosting profitability.

The income growth aspect of JNJ truly makes this such a great choice for dividend growth investors. Using Portfolio Visualizer, we can see the growth of income from an original investment of $10,000. This chart assumes that no additional capital was deployed and only dividends were reinvested. Your dividend income would have started out as $300 in 2014 and you'd now be receiving over $661 annually in 2024. Now imagine if you dollar cost averaged into JNJ a few times a year? Your income would grow substantially faster!

JNJ dividend income growth

Portfolio Visualizer

Risk

While I believe strong in my thesis that JNJ is undervalued, there are some risks and factors to consider. With the release of the March CPI Report, the chances of interest rate cuts are less likely. The probability that the federal funds rate will stay the same is now 73.2%. Higher inflation levels can impact consumer spending and reduce all around segment sales and profitability for JNJ. In addition, a higher federal funds rate can mean higher interest payments on debt obligations, although JNJ is currently AAA rated this is less of a worry.

Most important, JNJ has been plagued with ongoing fines and lawsuits. While this has almost always been the case for the company, large lawsuits and settlements chew into profitability. Cough syrup was recently recalled in Nigeria over toxicity concerns. Although early in the process, who knows how far these things can go. Sometime it seems like the abundance of negative news over powers the financials of the company. For example, JNJ may have to pay $700M to settle a talcum powder lawsuit due to marketing this controversial product. In addition, there is also a baby powder suit for $75M that JNJ has to settle with the state of Mississippi. However, $75M is essentially immaterial for JNJ so this is a win.

Takeaway

Johnson & Johnson (JNJ) has had their stock price beaten up for the better part of a year. While the entire healthcare sector has also lacked growth to keep up with the S&P 500 (SPY), I believe this to present a great opportunity to initiate a position or add more shares at these price levels. From a valuation perspective, the stock remains cheap with an average Wall St. target of $175 per share and my own personal dividend discount calculated estimate fair value of $188.85 per share. This presents an opportunity for appreciation anywhere between 16 - 25% after the recent price drop. This becomes even more attractive when you consider that you will also be collecting one of the most reliable dividend streams out there, with a current dividend yield of 3%.

I feel that JNJ has a lot of strong indicators aligned at the moment. Under valuation, a strong dividend, excellent revenue growth across segments, and a current Dog of the Dow. The Dog of the Dow strategy is by no means failproof, but it has historically offered greater downside protection and potential to outperform the greater indexes. On going lawsuits and settlements may disrupt the price movement in the short term, but the fundamentals are strong so I believe will succeed and provide long term growth. As a result, I rate shares of JNJ as a Strong Buy.

https://seekingalpha.com/article/4683388-johnson-and-johnson-doubling-down-on-this-2024-dog-of-the-dow-jnj-stock

Saturday 13 April 2024

Unlocking Q1 Potential of Johnson & Johnson (JNJ)

Unlocking Q1 Potential of Johnson & Johnson (JNJ): Exploring Wall Street Estimates for Key Metrics

Zacks Equity Research

Thu, 11 April 2024

Analysts on Wall Street project that Johnson & Johnson (JNJ) will announce quarterly earnings of $2.64 per share in its forthcoming report, representing a decline of 1.5% year over year. Revenues are projected to reach $21.38 billion, declining 13.6% from the same quarter last year.

The consensus EPS estimate for the quarter has been revised 0.1% higher over the last 30 days to the current level. This reflects how the analysts covering the stock have collectively reevaluated their initial estimates during this timeframe.

Prior to a company's earnings announcement, it is crucial to consider revisions to earnings estimates. This serves as a significant indicator for predicting potential investor actions regarding the stock. Empirical research has consistently demonstrated a robust correlation between trends in earnings estimate revision and the short-term price performance of a stock.

While investors typically use consensus earnings and revenue estimates as a yardstick to evaluate the company's quarterly performance, scrutinizing analysts' projections for some of the company's key metrics can offer a more comprehensive perspective.

In light of this perspective, let's dive into the average estimates of certain Johnson & Johnson metrics that are commonly tracked and forecasted by Wall Street analysts.

It is projected by analysts that the 'Sales- MedTech- Total' will reach $7.93 billion. The estimate indicates a change of +5.9% from the prior-year quarter.

The average prediction of analysts places 'Sales- Innovative Medicine- WW' at $13.44 billion. The estimate suggests a change of +0.2% year over year.

According to the collective judgment of analysts, 'Sales- MedTech- Orthopaedics- Trauma- WW' should come in at $778.57 million. The estimate indicates a year-over-year change of +2.9%.

The collective assessment of analysts points to an estimated 'Sales- MedTech- Orthopaedics- Spine, Sports & Other- WW' of $736.53 million. The estimate suggests a change of +1% year over year.

The combined assessment of analysts suggests that 'Sales- MedTech- Orthopaedics- Hips- US' will likely reach $250.20 million. The estimate points to a change of +3.8% from the year-ago quarter.

Analysts expect 'Sales- MedTech- Orthopaedics- Hips- International' to come in at $148.34 million. The estimate indicates a change of -0.4% from the prior-year quarter.

The consensus among analysts is that 'Sales- MedTech- Orthopaedics- Knees- US' will reach $232.66 million. The estimate suggests a change of +3% year over year.

Analysts predict that the 'Sales- MedTech- Orthopaedics- Knees- International' will reach $146.04 million. The estimate indicates a change of +2.9% from the prior-year quarter.

Based on the collective assessment of analysts, 'Sales- MedTech- Orthopaedics- Trauma- US' should arrive at $500.35 million. The estimate indicates a change of +1.9% from the prior-year quarter.

The consensus estimate for 'Sales- MedTech- Orthopaedics- Trauma- International' stands at $278.12 million. The estimate indicates a year-over-year change of +4.2%.

Analysts' assessment points toward 'Sales- MedTech- Orthopaedics- Spine, Sports & Other- US' reaching $408.28 million. The estimate indicates a change of +0.6% from the prior-year quarter.

Analysts forecast 'Organic Sales Growth (Operational growth)' to reach 3.9%. Compared to the present estimate, the company reported 9% in the same quarter last year.

https://uk.finance.yahoo.com/news/unlocking-q1-potential-johnson-johnson-131516612.html?guccounter=1&guce_referrer=aHR0cHM6Ly93ZWIudGVsZWdyYW0ub3JnLw&guce_referrer_sig=AQAAAK_nMhZAe1ribDUlfq7jNLCGzhB6rKvlsS-KUUOj82rcWngephRqtPzRgmC2TVD0-pj5s6nIN8FCN8INkv3fJh20Fhdbhs4os3074-LFaafLgetXTx-c62-WAZcenyJlWHf_LjPLLa1uHQg-KPdTlKkM7UnRxMBKVFkDHRSLAAE3

Irredeemable Convertible Unsecured Loan Stock (ICULS)

Overview

What Is an Irredeemable Convertible Unsecured Loan Stock (ICULS)?

An irredeemable convertible unsecured loan stock (ICULS) is a hybrid security that has some qualities of a debt instrument and some characteristics of an equity warrant. Like a bond, an ICULS pays a fixed interest coupon to the holder semi-annually or annually at a predetermined rate. Like a warrant or a convertible bond, an ICULS can be converted into common shares of stock, which can appreciate in value for the investor.

ICULs are issued by governments or companies seeking to finance existing operations or new projects. They are especially common in Malaysia, where young or financially weak companies use them to gain access to new capital.

KEY TAKEAWAYS

Irredeemable convertible unsecured loan stock (ICULS) refers to hybrid shares of common or preferred stock that used borrowed funds from investors.

Like convertible bonds, ICULS can be converted into newly issued shares of common stock at a set conversion ratio and price.

ICULS loans are not secured by any collateral, making them more risky and subordinate to other forms of securities.

Understanding an Irredeemable Convertible Unsecured Loan Stock

ICULS's are called "loan stocks" because investors are essentially loaning funds to the issuer. In return, investors enjoy periodic interest income until the ICULS is converted into equity from which the holders receive dividends declared.

The ICULS can be converted to equities at any time up to the expiration date. Some ICULS's require a mandatory conversion when they mature. On this date, the conversion is done automatically, regardless of whether the holder of the security surrenders them or not.

Upon issuance, the ICULS specifies the conversion ratio at which its underlying loan can be converted into stock (one of its distinctions from a conventional warrant). For example, if the conversion ratio is 20:1, this means that one ICULS can be converted into 20 common shares.

The conversion price is the price at which ICULS can be converted into common shares, and it is determined by the conversion ratio. If an ICULS is trading for a nominal value of RM1,000 with a conversion ratio of 20, then the conversion price is RM1,000/20 = RM50. The holder has no choice but to receive the 10 underlying stocks even if the current market price of the stock is less than RM50.

Pros and Cons of Irredeemable Convertible Unsecured Loan Stock

If the current market price of the stock at the time of conversion is less than the conversion price (conversion price RM 50 and market price RM 40, say, using the above example), the ICULS is said to be out of the money. In this case, the holder of the security will be required to pay the difference between the conversion price and the stock price in order to receive the underlying shares. On the other hand, if the stock price is higher than the conversion price, the ICULS is in the money, and the holder receives the stipulated number of shares without having to pay any additional cost.

Special Considerations for Irredeemable Convertible Unsecured Loan Stock

The loan given to an ICULS issuer is not secured by collateral. In the event of default, there is no guarantee that holders will be able to recover their principal investments and future coupon payments. In addition, ICULS cannot be redeemed for cash (hence the "irredeemable" in their name)—a key way in which they differ from conventional convertible bonds. Since they are unsecured and can't be cashed in, ICULS are ranked low on the hierarchy of claims and are subordinate to all other debt obligations of the company.

When irredeemable convertible unsecured loan stock is converted, new shares are issued. When new shares are issued, this results in full dilution for existing shareholders in the company as the total number of shares outstanding increases, leading to a decrease in earnings per share (EPS).

Reference:

By TROY SEGAL

Troy Segal is an editor and writer. She has 20+ years of experience covering personal finance, wealth management, and business news.

Reviewed by JEFREDA R. BROWN

Friday 12 April 2024

Understanding ROE

SUMMING IT UP

If you want to use fundamental analysis effectively, you must have a clear understanding of your tools. Currently, this can be hard to do when you are looking at ROE figures because of the inconsistencies in the measurement of ROE.

However, if it’s important to express profit margins as “gross margins,” “operating margins,” or “pre-tax margins,” then it’s equally essential to identify ROE as “net return on beginning equity,” “EACS return on average equity,” or the like. At least, in that scenario, anyone using those ratios will be able to assess their shortcomings and make rational analyses and comparisons.

At a minimum, if you are analyzing a company, you need to understand how the ROE figures weregenerated, and be aware of distortions that can occur depending on the equity figure used.

Use "normalized income after taxes."

If you are calculating ROE on your own, it should be calculated using the most “stripped-down” income available; i.e., “normalized income after taxes,” which excludes all non-recurring and extraordinary items from the income derived from continuing operations. This is not all that easy to come by. Either you, or your data provider’s analysts must estimate the tax implications for the non-recurring items excluded, since such items appear above the tax line on the income statement. At this time, the only data providers I know of that offer normalized earnings are Value Line (www.valueline.com) and Market Guide (www.marketguide.com).

As a practical matter, the second best and probably the “most likely to succeed” would be income available to common shares from continuing operations excluding extraordinary items. And the net income after taxes would be a near next choice.

Best to divide income by beginning equity

The income source, so long as it’s identified, is not the crucial issue however. Far more important is that, whatever income is used, it should be divided by beginning equity in order to exclude any distortions that arise from changes to equity—especially those from the retained earnings. The concept of return must be simple. Whatever incremental increases in income may result from the use of that income should be regarded merely as effective utilization of the beginning equity that produces the return.

At the very least, for those that use average or ending equity, if it’s worth the trouble to consider return on equity at all, then it’s worth the trouble to back out the items that affect changes in equity during the period, if not the retained earnings. The use of average equity is not good, but beats ending equity.

Probably the least useful calculation of ROE uses earnings per share divided by ending book value, because that figure is not only distorted by all of the issues raised above, but it’s also subject to the additional inaccuracies that come from using different values for outstanding shares—e.g., diluted, average, weighted average, shares at the beginning or end of the period—to arrive at the top and bottom of the equation.

To be useful, ROE must be calculated using components that clarify, rather than distort, the return picture. Or, at the very least, as an analyst you must be aware of those possible distortions by being aware of the components used in the calculation. Without this awareness, I would suggest that ROE is simply not what it’s cracked up to be.

Tuesday 9 April 2024

Monday 8 April 2024

Before Investing, You Should Understand What Drives the Price. It’s Always About Supply and Demand

Wednesday 3 April 2024

Friday 15 March 2024

Thursday 14 March 2024

Fast Growers

Traits

• Small, aggressive new companies. Growing

at 20-25%.

• Land of the 10-40x, even 200x. 1-2 such

companies can make a career.

• Lousy Industry

o May not belong to fast growing industry.

Can expand in the room in a slow growth

industry by taking market share.

o Depressed industries are likely places to

find potential bargains. If business

improves from lousy to mediocre, you are

rewarded, rewarded again when mediocre

turns to good, and good to excellent.

o Moderately fast growers (20-25%) in slow

growth industries are ideal investments.

Look for companies with niches that can

capture market share without price

competition. In business, competition is

never as healthy as total domination.

o Growth ≠ Expansion, leading people to

overlook great companies like Phillip

Morris. Industry wide cigarette

consumption may decline, but company

can increase earnings by cost cuts and

price increases. Earnings growth is the

only growth that really counts. If costs

rise 4%, but prices rise 6%, and profit

margin is 10%, then extra 2% price rise

= 20% increase in earnings.

o Greatest companies in lousy industries

share certain characteristics:

i) low cost operators / penny pinchers

in the executive suite

ii) avoid leverage

iii) reject corporate hierarchies

iv) workers are well paid and have a

stake in the company’s future

v) they find niches, parts of the market

that bigger companies overlook. Zero

Growth Industry = Zero Competition.

• Hot Industry

o Hot Stocks + Hot Industry = Greater

Competition. Companies can thrive only

due to niche/moat/patents etc.

o Growth ≠ Expansion. In low growth

industries, companies expand by

capturing market share, cutting costs

and raising prices. When an industry

gets too popular, nobody makes money

there anymore.

• Life Phases of a Fast Grower: each may last

several years. Keep checking earnings,

growth, stores to check aura of prosperity.

Ask, what will keep earnings going?

i) Startup phase: companies work out

kinks in the basic business. Riskiest

phase for the investor because success is

not yet established.

ii) Rapid Expansion: company enters new

markets. Safest phase for investor where

most amount of money is made, because

growth is merely an act of duplication

across markets. Company reinvests all

FCF into expansion. No dividends help

faster expansion. IPO helps in expanding

without bank debt / leverage.

iii) Maturity / Saturation: company faces the

fact that there’s no easy way to continue

expansion. Most problematic phase

because company runs into its own

limitations. Other ways must be found to

increase earnings, possibly only, via

luring customers away from competitors.

If M&A / diworseification follows, then

you know management is confused.

• Find out growth plans and check if plan is

working?

i) Cost cuts – the proof is in decrease of

selling and administrative costs.

ii) Raise prices

iii) Entry into new markets

iv) Sell more volume in existing markets

v) Exit loss making operations

• What continues to triumph, vs, flop, is:

i) Capable management

ii) Adequate financing

iii) Methodical approach to expansion – slow

but steady wins this kind of race.

o When a company tries to open >100

stores/year, it’s likely to run into

problems. In its rush to glory, it can

pick the wrong sites or managers, pay

too much for real estate, and, fail to

properly train employees. It is easier

to add 35-40 stores / year.

• Re-classification away from Fast Grower

o A large fast growth company faces

devaluation risk, since growth may slow

down as it runs out of space for further

expansion.

o Inability to maintain double digit growth

may see a re-classification into a Slow

Grower, Cyclical or Stalwart. High fliers

of one decade are groundhogs of the next.

o Fast Growers like hotels/retail having

prime real estate turn into Asset Plays.

o There’s high risk, especially in younger

companies that are overzealous and

underfunded. The headache of

underfinancing may lead to bankruptcy.

o Fast Grower’s that can’t stand prosperity,

diworseify, fall out of favour, and, turn

into Turnaround candidates.

o Every Fast Grower turns into a Slow

Grower, fooling many people. People have

a tendency to think that things won’t

change, but eventually they do,

o Very few companies switch from being a

Slow Grower to a Fast Grower.

o Companies may fall into 2 categories at

the same time, or, pass through all

categories over time (Disney).

• During 1949-1995, an investment in the 50

growth stocks on Safian’s Growth Index

returned 230x, while the Safian Cyclical

Index only returned 19x.

• Growth companies were the star performers

during and after 2 corrections (1981-82 and

1987), and they held their own in the 1990

Saddam selloff. The only time you wished

you didn’t own them was 197374, when

growth stocks were grossly overpriced.

Buying and Holding Tips

• Fast Grower => 2x GNP growth rate.

Sustaining 30% growth rate is very difficult,

even for 3 years. 20-25% growth rate is more

sustainable (investing sweet spot).

• Best place to find a 10x stock is close to

home – if not the backyard, then in the

kitchen, mall, workplace etc. You’ll find a

likely prospect ~2/3 times a year. The

person with the edge is always in a position

to outguess the person without an edge.

• Long shots almost never pay off. Better to

miss the 1st stock move (during phase I), or

even the late stage of phase I, when the

company’s only reached 5-10% of market

saturation, and wait to see if it’s plans are

working. If you wait, you may never need to

buy, since failure would’ve become visible.

• Does the idea work elsewhere? Must prove

that cloning works in other markets, and

show its ability to survive early mistakes,

limited capital, find required skilled labour.

• The most fascinating part of long term, Fast

Growers is how much time you have to catch

them. Even a decade later and with stock

already up 20x, it’s not too late to capitalize

on an idea that has still not run its course.

• Emerging growth stocks are much more

volatile than larger companies, dropping and

soaring like sparrow hawks around the

stable flight of buzzards. After small caps

have taken one of these extended dives, they

eventually catch upto the buzzards.

• Small Company Index PE / S&P 500 PE:

Since small companies are expected to grow

faster than larger ones, they’re expected to

sell at higher PE’s, theoretically. In practice,

this isn’t always the case. During periods

when Emerging Growth is unpopular with

investors, these small caps get so cheap that

their PE = S&P 500 PE. When wildly popular

and bid up to unreasonably high levels, it is

= 2x S&P 500 PE.

• In such cases, small caps may get clobbered

for several years afterward. Best time to buy

is when Small PE / Large PE < 1.2x. To reap

the reward from this strategy, you’ve to be

patient. The rallies in small cap stocks can

take a couple of years to gather storm and

then several more years to develop.

• A similar pattern applies to the Growth vs

Value pots. Be patient. Watched stock never

boils. When in doubt, tune in later.

• Look for a good balance sheet and large

profits. Trick is in figuring out when the

growth stops and how much to pay for it?

• Recent price run-ups shouldn’t matter, so

long as PEG still makes it attractive.

• If PEG =1x, then 20% growth @ 20x PE is >

10% growth @ 10x PE. Higher compounded

earnings will compensate even for PE

multiple shrinkage.

• High PE leaves little room for error. Best way

to handle a situation where you love the

company but not the price (great company,

high growth, but high PE), is to make a

small commitment and then increase it in

the next selloff. One can never predict how

far the price may fall. Even if you buy after a

setback, be prepared for further declines

when you might consider buying even more

shares. If the story is still good, after review,

then you’re happy that the price fell.

• So, the important issue is why has the stock

fallen so much? If the long term story is still

intact and the growth will continue for a

long time, then buy more. If you can place

the company in its attractive, mid-life phase,

ex. 2nd decade of 30 years of growth, then

you shouldn’t mind paying 20x PE for a 20-

25% growth rate, especially if market PE =

18-20x with an 8-10% growth rate.

• If you sell at 2x, you won’t get 10x. As long

as same store sales are rising, company isn’t

crippled with excess debt, and is following

its stated expansion plans, stick around. If

the original story stays intact, you’ll be

amazed at the results in several years.

• Trick is to not lose a potential 10x, but know

that, if earnings shrink, then so will the PE

that’s been bid up high – double whammy.

• It’s harder to stick with a winning stock after

price increases, vs, continuing to believe in a

company after price falls. If you’re in danger

of being faked out into selling, revisit the

reasons / story, as to why you bought it in

the first place. There are 2 ways investors

can fake themselves out of the big returns

that come from great growth companies.

i) Waiting to buy the stock when it looks

cheap: Throughout its 27-year rise from

a split-adjusted 1.6 cents to $23, WalMart

the market. Its PE rarely dropped <20x,

but earnings were growing at 25-30%

Any business that keeps up a 20-25%

growth rate for 20 years rewards its

owners with a massive return even if the

overall market is lower after 20 years.

ii) Underestimating how long a great

growth company can keep up the pace.

These "nowhere to grow" theories come

up often & should be viewed sceptically.

o Don't believe them until you check

for yourself. Look carefully at where

the company does business and at

how much growing room is left.

Whether or not it has growing room

may have nothing to do with its age.

o Wal-Mart IPO’d in 1970. By 1980 =

stock 20x, with 7x number of stores.

Was it time to sell, not be greedy, &

put money elsewhere? Stocks don’t

care who owns it and questions of

greed are best resolved in church,

not in brokerage accounts.

o The important issue to analyze was

not whether the Wal-Mart stock

would punish its holders, but

whether the company had saturated

the market. The answer was No.

Wal-Mart’s reach was only 15% of

USA. Over the next 11 years, the

stock went up another 50x.

Sell When

• Hold as long as earnings are growing,

expansion continues and no impediments

arise. Check the story every few months as if

you’re hearing it for the very first time.

• If a Fast Grower rises 50% and the story

starts sounding dubious, sell and rotate into

another, where the current price is <= your

purchase price, but the story sounds better.

• Main thing to watch is the end of phase II of

rapid expansion. Company has no new

stores, old stores are shabby, and the stock

is out of fashion.

• Wall Street covers the stock widely,

institutions hold 60%, and 3 national

magazines fawn over the CEO.

• Large companies with 50x PE!? Even at 40x,

and with wide, saturated presence, where

will the large company grow?

• Last quarter same-store sales are down 3%,

new store sales are disappointing, and the

company is telling positive stories, vs,

showing positive results.

• Top executives / employees leave to join a

rival.

• PE = 30x, but next 2 years’ growth rate =

15%. Therefore, PEG = 2x (very negative)

Examples

• Annheuser Busch, Marriott, Taco Bell,

Walmart, Gap, AMD, Texas Instruments,

Holiday Inn, carpets, plastics, retail,

calculators, disk drives, health maintenance,

computers, restaurants

• While it’s possible to make 2-5x in Cyclicals

and Undervalued situations (if all goes well),

payoffs in Fast Growers like restaurants and

retailers are bigger. Restaurants/retailers

can expand across the country and keep up

the growth rate at 20% for 10-15 years.

• Not only do they grow as fast as high tech

companies, but unlike an electronics or shoe

company, restaurants are protected from

competition. Competition is slower to arrive

and you can see it coming. A restaurant

chain takes a long time to work its way

across the country and no foreign company

can service local customers.

• Taste homogeneity helps scale in food,

drinks, entertainment, makeup, fashion etc.

Popularity in 1 mall = popularity in another.

Certain brands prosper at else’s expense.

• Ways to increase earnings (restaurants):

i) Add more locations

ii) Improve existing operations

iii) High turnover with low priced meals

iv) High priced meals with lower turnover

v) High OPM because of food made with

cheaper ingredients, or, due to low

operating costs

• To break even, a restaurants’ sales must =

Capital Employed. Restaurant group as a

whole may only grow slowly at 4%, but as

long as Americans eat >50% of their meals

out of home, there’ll be new 20x stocks.

People Examples

• Higher failure rate than Stalwarts, but if and

when one succeeds, it may boost income 10-

20-100x.

• Actors, real estate developers, musicians,

small businessmen, athletes, criminals

PE Ratio

• Highest for Fast Growers at 14-20x.

Company with a High PE must have

incredible growth (for next 2 years) to justify

its price. It’s a miracle for even a small

company to justify a 50x PE, as may so

happen during a bull market.

• 1 year forward PE of 40x = dangerously high

and in most cases extravagant. Even fastest

growing companies can rarely achieve 25%

growth, and 40% is a rarity. Such frenetic

growth isn’t sustainable for long & growing

too fast tends to lead to self destruction.

• 40x PE @ 30% growth isn’t attractive, but

not bad if S&P 500 = 23x PE & Coke PEG =

2x (PE = 30x @ 15% growth).

• Unlike Cyclical where the PE contracts near

the end of the cycle, Fast grower’s PE gets

bigger and may reach absurd, illogical levels.

• Earnings are not constant and PE of 40x vs

3x shows investor willingness to gamble on

higher earnings, vs, scepticism about the

cheaply priced company’s future.

PEG

• Where and how can the company continue

to grow fast?

• La Quinta Motels started in Texas. Company

successfully duplicated its formula in

Arkansas & Louisiana. Last year it added

28% more units. Earnings have increased

every quarter. Plans rapid future expansion

& debt isn’t excessive. Motels are low growth

industry and very competitive but La Quinta

has found something of a niche. Long way to

go before it saturates the market.

Checklist

• Percentage of sales – is a new fast growing

product a large % of sales?

• Recent growth rate – favour 20-25% growth

rates. Be wary if growth is > 25%. Hot

industries show growth >50%.

• Proof – has company duplicated its success

in >1 city, for planned expansion to work?

• Runway – does it still have room to grow?

• PE – is it high or low, vs, growth rate?

• Δ Growth rate – is expansion speeding up or

slowing down? For companies doing sales

via large, single deals, vs, selling high

volume & low ticket items, growth slowdown

can be devastating because doing more

volume at bigger ticket sizes is difficult.

When growth slows, stock drops

dramatically.

• Institutional ownership / Analyst coverage –

no presence is a positive, as growth

expectations are still not captured in the

Price or PE.

Portfolio Allocation %

• 30-40% Allocation in Magellan. Magellan’s

allocation to Fast Growers was never >50%.

• 40% in Personal investor’s 10 stock portfolio

• If looking for 10x stocks, likelihood increases

as you hold more stocks. Among several, the

one that actually goes the farthest maybe a

surprise. The story may start at a certain

point, with specific expectations, and get

progressively better. There’s no way to

anticipate pleasant surprises.

• More stocks provide greater flexibility for

fund rotation. If something happens to a

secondary company, it may get promoted to

being a primary selection.

Risk/Reward

• High Risk – High Gain. Higher potential

upside = Greater potential downside.

• +10x / (-100%)

• Major bankruptcy risk for small fast grower’s

via underfinanced, overzealous expansion

• Major rapid devaluation risk for large fast

growers once growth falters, because there’s

no room left for future expansion

Twitter@mjbaldbard 10 mayur.jain1@gmail.com

Stalwarts

Traits

• Growth rate = 2x GNP growth rate

• Growth Rates: Slow Growers (1x GNP) <

Stalwarts (2x GNP) < Fast Growers (20-25%)

• Fairly large sized companies

• You can profit, based on time and price of

purchase. Long term return will be = bonds

• Good performers, but not stars – 50% return

in 2 years is a delightful result. Sell more

readily than Fast Growers.

• Good performers in good markets. Take 30-

50% returns, and then rotate money into

another Stalwart.

• Operating performance of such defensives

helps them survive recessions. No down

quarter for 20-30 years.

• Offer good protection in hard times. Won’t go

bankrupt, soon enough they’ll be

reassessed, and their value will be restored.

• Don’t hold after 2x, hoping for 10x. Can hold

for 20 years only if you bought a “Great”

company at a “Good” price.

• Can hardly go wrong by making a full

portfolio of companies that have raised

dividends for 10-20 years in a row.

• Hidden assets like brands & patents grow

larger, while the company punishes P&L

EPS via amortization, R&D, branding etc.

EPS will jump when these expenses stop, or,

the new product hits the market.

o Due to these hidden assets and low

maintenance capex, FCF > EPS.

o Possible to cut costs, raise prices and

also capture market share in slow growth

markets.

o If you can find a company that can raise

prices without losing customers, you’ve

found a terrific investment.

Examples

• Pharma, Tobacco, FMCG, Alcohol

People Examples

• Command good salaries and get predictable

raises – mid level employees

PE Ratio

• Average = 10-14x.

• PEG <0.5-1x is fine, but 2x is expensive.

2 Minute Drill

• Key issues are PE, recent price run-ups, and

what, if anything is happening to accentuate

growth rate?

• Coke is selling at the low end of its PE range.

Stock hasn’t gone anywhere for 2 years, even

though the company has improved in many

ways. Sold 50% of Columbia Pictures. Diet

drinks have dramatically sped up growth

rate. Foreign sales are excellent. Has better

control over sales & distribution after buying

out many independent, regional distributors.

Thus, it may do better than people think.

Checklist

• Price = key issue, since these are big

companies that aren’t likely to go out of

business

• Diworseification – capital misallocation may

reduce future earnings. Board of Directors’

is better off returning cash to shareholders.

• Long Term Growth Rate – has company kept

up with growth rate momentum in recent

years? Is it slowing/speeding?

• Long Term Holding – how did it fare during

previous recessions / market correction?

Portfolio Allocation %

• 10-20% Allocation, in order to moderate

risks in portfolio full of Fast Growers and

Turnarounds.

• Average 20% Allocation in a personal

investor’s 10 stock portfolio.

Risk/Reward

• Low Risk – Moderate Gain.

• 2 year hold may give 50% upside vs 20%

downside.

• 6 rotations of 25-30% CAGR Stalwarts = 4-

5x, or 1 big winner.

Sell When

• Stalwarts with heavy institutional ownership

and lots of Wall Street coverage, that have

outperformed the market and are overpriced,

are due for a rest or decline.

• 10x not possible. If P>E, or, PE>Normal, sell

and rotate. If Price gets ahead, but the story

is still the same, sell and rotate.

• New products of last 2 years have mixed

results & new testing products are >1 year

from market launch

• PE = 15x, vs similar quality company from

same industry at 11-12x PE

• No Executive/CXO/Director has bought

shares in last 1 year

• Large division (>25% of sales) is vulnerable

to an ongoing economic slump (housing, oil)

• Growth rate is slowing down and though

earnings have been maintained via cost

cuts, there’s no further room left.

Slow Growers

Traits

• Usually large and aging companies, whose

Growth rate = GNP Growth rate

• When industries slow down, most companies

lose momentum as well

• Easy to spot using stock charts

• Pay large and regular dividends

• Bladder theory of corporate finance: the

more cash that builds up in the treasury,

the greater the pressure to piss it away.

Companies that don’t pay dividends, have a

history of diworseification.

• Stocks that pay dividends are favoured vs

stocks that don’t. Presence of dividend

creates a floor price, keeping a stock from

falling away during market crashes. If

investors are certain that the high dividend

yield will hold up, then they’ll buy for the

dividend. This is one reason to buy Slow

Growers and Stalwarts, since people flock to

blue chips during panic.

• If a Slow Grower stops dividend, you’re

stuck with a sluggish company with little

going for it.

Examples

• GE, Alcoa, Utilities, Dow Chemical

People Examples

• Secure jobs + Low salary + Modest raises =

Librarians, Teachers, Policemen

PE Ratio

• Lowest levels, per PEG. Utilities = 7-9x

• Bargain hunting doesn’t make sense without

growth or other catalyst

• During bull market optimism, PE may

expand to Fast Growers’ PE of 14-20x

• Therefore, the only meaningful source of

return = PE re-rating

2 Minute Drill

• Reasons for interest?

• What must happen for the company to

succeed?

• Pitfalls that stand in the path?

• Dividend Play = “For the past 10 years the

company has increased earnings, offers an

attractive dividend yield, it’s never reduced/

suspended dividend, & has in fact raised it

during good and bad times, including the

last 3 recessions. As a phone utility, new

cellular division may aid growth.”

Checklist

• Dividends: Check if always paid and raised.

• Low dividend payout ratio creates cushion,

higher % is riskier.

Portfolio Allocation %

• 0% - NO Allocation, because without growth,

the earnings & price aren’t going to move.

Risk/Reward

• Low risk-Low gain, because Slow Growers

aren’t expected to do much and are priced

accordingly.

Sell When

• After 30-50% rise

• When fundamentals deteriorate, even if price

has fallen:

o Lost market share for 2 Quarters and

hires new advertising agency

o No new products/R&D, indicating that

the company is resting on its laurels

o Diworseification (>2 recent unrelated

M&A’s), excess leverage leaves no room

for buybacks/dividend increase

o Dividend yield isn’t high enough, even at

a lower price.

The Peter Lynch Playbook

Twitter@mjbaldbard 2 mayur.jain1@gmail.com

Turnarounds

Traits

• No growth, potential fatalities – a poorly

managed company is a candidate for trouble

• Make up lost ground very quickly and

performance isn’t related to market moves

• Can’t compile a list of failed Turnarounds,

since their records get deleted after collapse

• Turnaround types:

i) Bail Us Out Or Else: whole deal depends

on a government bailout.

ii) Who Would’ve Thought: can lose money

in utilities?

iii) Unanticipated Problem: minor tragedy

perceived to be worse, leading to major

opportunity. Be patient. Keep up with

news. Read it with dispassion. Stay away

from tragedies where the outcome is

immeasurable.

iv) Good Company Inside a Bad one:

possible bankruptcy spinoff. Look for

institutional selling and insider buying.

Did the parent strengthen the company’s

balance sheet pre-spinoff?

v) Restructuring: company diworseified

earlier, now the loss making business is

being sold off, costs cut etc.

• How will earnings change?

i) Lower costs

ii) Higher prices

iii) Expansion into new markets

iv) Higher volume sold in old markets

v) Changes in loss making operations

• Buy companies with superior financial

condition. Young company + Heavy Debt =

Higher Risk. Determine extent of leverage

and what kind is it? Long term funded debt

is preferable to Short/Medium term callable

bank debt, which may trigger bankruptcy.

• Inventory growth > Sales growth = Red flag,

& inventory growth is a bad sign. Depleting

inventory means things maybe turning

positive. High inventory build up overstates

earnings - may mean that management is

deferring losses by not marking down the

unsold items & getting rid of them quickly.

• Asset/inventory values maybe inflated. Raw

materials are liquidated better than finished

goods. Check for pension liabilities and

capitalized interest expense in asset values.

• Upswing favours Turnarounds > Normal

companies. So look for low margin

companies to succeed via operating leverage

/ high cost of production.

• If the industry is robust in general and the

company’s business doesn’t do well, then

one maybe pessimistic about its future.

• If the entire industry is in a slump & due for

a rebound, & the company has strengthened

its balance sheet and is close to the breakeven

point, then it has the potential to do

jumbo sales when the industry picks up.

• Name changes may happen due to M&A or

some fiasco that they hope will be forgotten.

• Are Turnarounds obvious winners? In

hindsight, yes, but a company doesn’t tell

you to buy it. There’s always something to

worry about. There are always respected

investors who say that you’re wrong. You’ve

to know the story better than they do and

have faith in what you know.

• For a stock to do better than expected, it has

to be widely underestimated. Otherwise, it’d

sell for a higher price to begin with. When

the prevailing opinion is more negative than

yours, you’ve to constantly check & re-check

the facts, to assure yourself that you’re not

being foolishly optimistic. The story keeps

changing for better or worse, and you’ve to

follow these changes and act accordingly.

• With Turnarounds, Wall Street will ignore

changes. The Old company had made such a

powerful impression that people can’t see

the New one. Even if you don’t see it right

away, you can still profit more than enough.

• Cyclicals with serious financial problems

collapse into Turnarounds. Also, fast

growers that diworseify & fall out of favour.

• If Slow Grower = Turnaround, then it’s

performance maybe > Stalwart/Fast Grower

• Remind yourself of the Even Bigger Picture –

that stocks in good companies are worth

owning. What’s the worst that can happen?

Recession turns into depression? Then

interest rates will fall, competitors will falter

etc. if things go right, how much can I earn?

What’s the reward side of the equation? Take

the industry which is surrounded by the

most doom and gloom. If the fundamentals

are positive, you’ll find some big winners.

Examples

• Auto (Ford Chrysler), paper, airlines

(Lockheed), steel, electronics, non-ferrous

metals, real estate, oil & gas, retail, Penn

Central, General Utilities, Con Edison, Toys

R Us spinoff, Union Carbide, Goodyear.

• Record with troubled utilities is better than

troubled companies in general, because of

regulations. A utility may cancel dividends /

declare bankruptcy, but if people depend on

it, a way must be found to let it continue

functioning. Regulation determines prices,

profits, passing on costs to customers. Since

the government has a vested interest in its

survival, the odds are overwhelming that it

will be allowed to overcome its problems.

• Troubled Utility Cycle:

i) Disaster Strikes: some huge cost (fuel)

can’t be passed along, or, because a huge

asset is mothballed & removed from the

base rate. Stock drops 40-80% in 1-2

years, horrifying people who view utilities

as safe & stable investments. Soon, it

starts trading at 20-30% P/B. Wall Street

is worried about fatal damage – how long

it takes to reverse this impression varies.

30% P/B implies bankruptcy, emergence

from which may take upto 4 years.

ii) Crisis Management: utility attempts to

respond by cutting costs and capex.

Dividend maybe decreased / eliminated.

Begins to look as if the company will

survive, but price doesn’t reflect the

improved prospects.

iii) Financial Stabilization: cost cuts have

succeeded, allowing it to operate on

current revenues. Capital markets maybe

unwilling to lend money for new projects

& it’s still not earning money for owners,

but survival isn’t in doubt. Prices recover

to 60-70% P/B, 2x from stage (i), (ii)

iv) Recovery At Last: once again capable of

earning and Wall Street has reason to

expect improved earnings and the

reinstatement of dividends. P/B = 1x.

How things progress from here depends

on, (a) reception from capital markets,

because without capital, a utility cannot

increase its base rates, and, (b) support

from regulators’, ie, how many costs are

allowed to be passed on?

• One person’s distress is another man’s

opportunity. You don’t need to rush into

troubled utilities to make large profits. Can

wait until the crisis has abated, doomsayers

are proven wrong, and, still make 2-4x in

short term. Buy on the omission of dividend

& wait for the good news. Or buy when the

first good news has arrived in stage (ii).

• The problem that some people have is they

think they’ve missed it if the stock falls to

$4, then rebounds to $8. A troubled

company has a long way to go and you’ve to

forget that you’ve missed the bottom.

People Examples

• Guttersnipes, drifters, down and outers,

bankrupts, unemployed – if there’s energy

and enterprise left.

2 Minute Drill

• Has the company gone about improving its

fortunes and is the plan working?

• General Mills has made great progress on

diworseification. Cut down from 11 to 2

businesses that are key and the company

does best. Others were sold at good price

and the cash was used for buybacks. 1 key

business’ market share has improved from 7

to 25% and is coming up with new products.

Earnings are up sharply.

Checklist

• Plan – how will it turnaround? Sell loss

making subsidiaries? Cut costs? What’s the

impact of these actions? Is business coming

back? New products?

• Survival – can it survive a raid by short term

creditors? Check cash/debt position, capital

structure, can it sustain more losses?

• Bottom Fishing – if it’s bankrupt already,

then what’s left for owners?

• 20-50% Allocation, based on where greater

value exists - Turnarounds or Fast Growers

Risk/Reward

• High Risk – High Gain.

• Higher potential upside (10x) vs higher

potential downside (100% loss).

Sell When

• After Turnaround is complete, trouble is

over, everyone is aware of changed situation,

& the company is re-classified as a Cyclical/

Fast/Slow Grower etc. Stockholders aren’t

embarrassed to own the shares anymore.

• Stock is judged to be a 2x, but not 5-10x

• PE is inflated vs Earnings prospects, sell and

rotate into juicier Turnaround opportunities,

where Fundamentals are better than Price.

• Debt, which has declined for 5 consecutive

quarters, rises again. Indicates increased

chances of relapse.

• Inventory rise > 2x Sales increase.

• >50% sales of the company’s strongest

division’ come from some customer whose

sales are slowing down.

The Peter Lynch Playbook

Twitter@mjbaldbard 5 mayur.jain1@gmail.com

When you buy into stocks you need to understand why you are buying. In doing this, it helps to categorise the company in determining what sort of returns you can expect. Catergorising also enforces some discipline into your investment process and aids effective portfolio construction.

Peter Lynch uses the six categories below;-

• Sluggards (Slow growers) – Usually large companies in mature industries with earnings growth below or around GDP growth. Such companies are usually held for dividend rather than significant price appreciation.

• Stalwarts (Medium growth) - High quality companies such as Coca-Cola, P&G and Colgate that can still churn out high single digit/low teens growth. Earnings patterns are not cyclical meaning that these stocks will protect you recession.

• Fast growers – Companies whose earnings are growing at 20%+ and have plenty of runway to attack e.g. think Google, Apple in their early days. It doesn’t have to be a company as “sexy” as those mentioned.

• Cyclicals – Companies whose fortunes are closely linked to the economic cycle e.g. automobiles, financials, airlines.

• Turn-arounds – Companies coming out of a depressed phase as a result of change in management, strategy or corporate restructuring. Successful turnarounds can deliver stunning returns.

• Asset plays – Firm has hidden assets which are undervalued or not recognized at all on the balance sheet or under appreciated by the market e.g. cash, land, property, holdings in other company.

Comment:

General observations about different types of stocks.

Wall Street does not look kindly on fast growers that run out of stamina and turn into slow growers and when that happens the stock is beaten down accordingly.